My ROI stock portfolio experiment; the results

🔗 Permalink

A year has passed since my first post about my ROI stock portfolio and that means it is time to see how it went.

The portfolio

As of 10th of August 2023, using USD-based percentages, the portfolio looks like this:

| Stock | Return |

|---|---|

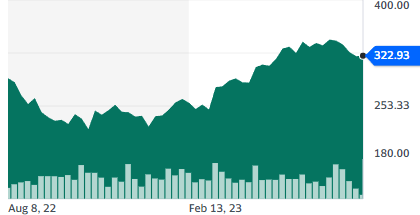

| Novo Nordisk (NVO) | ✔️(42.25%) |

| Applied Materials (AMAT) | ✔️(37.67%) |

| Southern Copper (SCCO) | ✔️(34.97%) |

| KLA Corporation (KLAC) | ✔️(33.28%) |

| Microsoft (MSFT) | ✔️(24.82%) |

| Apple (AAPL) | ✔️(18.09%) |

| Crescent Point Energy (CPG) | ✔️(16.57%) |

| Mastercard (MA) | ✔️(13.67%) |

| Blackstone Inc (BX) | ✔️(13.64%) |

| S&P Global (SPGI) | ✔️(11.33%) |

| McDonald's (MCD) | ✔️(7.51%) |

| Paychex (PAYX) | ✔️(7.00%) |

| Lousiana Pacific (LPX) | ✔️(6.95%) |

| Qualcomm (QCOM) | ❌(-7.96%) |

| Rio Tinto (RIO) | ❌(-10.97%) |

| Vale (VALE) | ❌(-11.35%) |

| Vermillion Energy (VET) | ❌️️(-12.60%) |

In US Dollars this is a 14.4% return, which is not bad at all. Foreign exchange rates however gave me a -5% if I were to convert it to Euros straight away.

Luckily, since end of July, Trading212 has a new feature where you can hold multiple currencies. So I have sold all stocks in USD (except for RIO, which I converted to EUR) and hope that when the time is better I can convert it to Euros.

I have also received €11.18 Euro in dividends, which is a 1.11% return on top of the others. (I will probably receive a couple more dividends, since some of the ex-dividend dates have not had their paydate yet)

It was a bumpy ride, barely seen green till the end, luckily I was able to buy in 2022 (which was a down-year) and could hold the first months of 2023 which have proven to be a rebound. In fact, I was debating near the top (July 31st) whether I should sell already or really wait for the August 10th date.

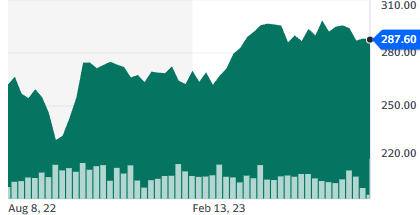

As you can see from the graph and know from the initial post, I paid €100 for 10 months, so after May 10th I just let it ride. Most of the gains in the market started from March and my gains only started becoming visible around May itself.

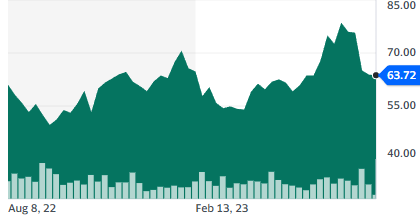

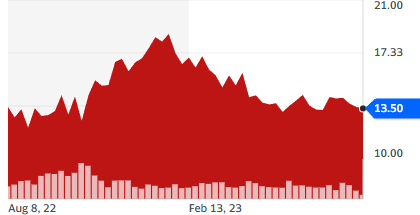

Some stocks were somehow always in the green (NVO, SCCO) and others pretty much just red (VET).

In January my mining stocks were doing well, but now both VALE and RIO are in the negative.

Learnings

-

The idea of the portfolio was solid. I had good dividend-paying companies. It was well diversified.

-

When in the growing phase, buying the same percentage amount is really nice. No stress whether you should rebalance while buying.

-

If you plan for the short term, the FX effect can be quite a large chunk. In August, but also in January, I was down 5% on the USD-EUR exchange rate.

The difference between the highest and lowest point this year was actually 15%. -

A criteria I added to my actual portfolio is checking the dividend history a bit more. This is mostly a feeling-type of check, but if I had done that for VET, I would have seen that their history didn't look so good since 2019.

-

It is still really difficult to predict anything. For example, I still wonder why Qualcomm (QCOM) is down and not recovering. Mastercard (MA) has also not gained as much, which they needed to, because their dividend is only 0.58%.