Verkiezingen

📅

—

🧮 701 woorden

— 🏷️

kinderen

politiek

🔗 Permalink

We zijn een paar dagen verder, de uitslagen staan nu vast. D66 is de opvallende winnaar, maar de uitslag betekent gewoon rechts.

Ik vind het moeilijk om daar mee om te gaan. Van nature was ik al links, maar heb het de afgelopen jaren ook echt steeds rechtser zien worden. Het hele Overton-venster is aan het verschuiven.

Als linkse vegan stemde ik al vaak Partij voor de Dieren, maar in 2021 stemde ik op BIJ1. In 2023 stemde ik weer PvdD, maar dat jaar haalde BIJ1 geen zetels, en verloren we Sylvana Simons. Dit jaar geprobeerd dat te herstellen, door weer op BIJ1 te stemmen, maar helaas geen zetels.

💬 Lees meer

Kinderboerderijen

📅

—

🧮 237 woorden

— 🏷️

kinderen

uitjes

🔗 Permalink

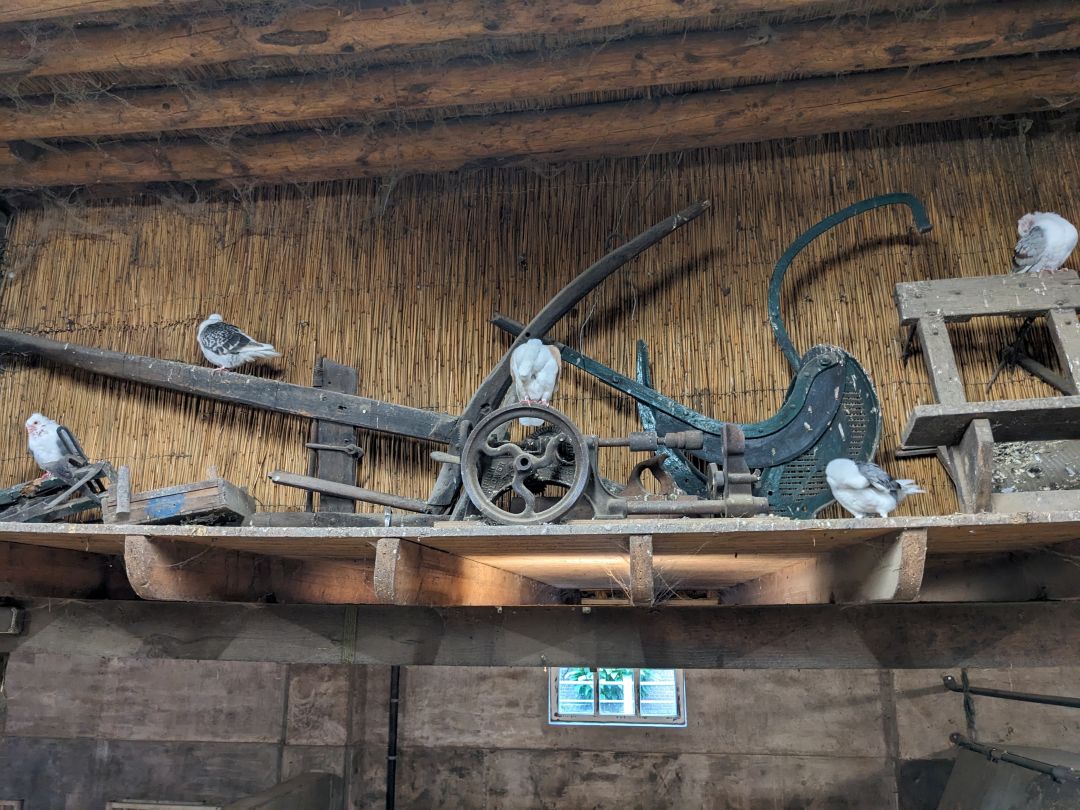

Kinderboerderijen zijn een uitstekende plek voor uitjes met kinderen.

De meeste beschikken over een speeltuin, traptrekkers en soms nog ander speelgoed voor binnen.

Afgelopen weekend gingen we opzoek naar een 'nieuwe' voor ons. Deze keer vonden we de Stadsboerderij Korenmaat in Arnhem.

Deze boerderij heeft van alles; dieren (schapen, geiten, varkens, kippen, konijnen, duiven, cavia's, paarden..), een grote speeltuin (schommels, glijbaan, klimrek, speelhuisje, zandbak, tokkelbaan), buitenruimte met traptrekkers, fietsjes, bankjes en picknicktafels, met informatieborden over de dieren, en ook van die leuke bordjes met gebarentaal.

💬 Lees meer

Het begin van een Nederlands blog

📅

—

🧮 178 woorden

— 🏷️

meta

🔗 Permalink

Een Nederlands blog? Hoe zit dat?

Een tijdje terug, naar aanleiding van het leren over IndieWeb, was ik begonnen om mijn destijds portfolio website (gerben.dev) om te toveren naar een volwaardige site.

Dit betekent ook blogposts, en aangezien ik hier heel veel technische posts had staan (en het ‘.dev’ domain voor ‘developer/development’ staat), heb ik deze gemigreerd naar gerben.dev. Je kunt ze alle vinden met #BlogMigration.

Mijn halve leven is Engels-talig geweest, van vrienden tot werk. Maar af en toe heb ik ideeën voor blogposts die daar eigenlijk niet passen.

💬 Lees meer

Gerben Jacobs is een 37-jarige software engineer uit Ede, Nederland, hij woont daar met zijn vrouw en twee kinderen.

Ik houd van wandelen, muziek, games (zowel video- als bordspellen), geschiedenis (Ja, ik denk weleens aan het Romeinse Rijk) en technologie.

🇬🇧 This is my Dutch blog. Check out my English-based site at gerben.dev.

I don't have an About page, but I do have a Now page.

GitHub

GitHub

Fediverse

Fediverse

LinkedIn

LinkedIn

RSS

RSS

Sitemap

Sitemap

Blogpost archief

Blogpost archief